In the dynamic world of trading, prop firms have long been viewed as gateways to financial opportunity, offering traders access to capital and resources to amplify their trading endeavors. However, the recent unraveling of The Funded Trader, a once-prominent prop trading firm, has shed light on the darker side of this industry, marked by payout denials and shattered dreams.

At its inception, The Funded Trader garnered attention for its innovative model, providing aspiring traders with the chance to trade sizable capital without risking their own funds. With a stringent evaluation process in place, traders could showcase their skills and potentially gain access to substantial trading accounts funded by the firm.

For many traders, The Funded Trader seemed like a beacon of hope in an often daunting landscape. Armed with significant capital and support from the firm, traders embarked on their trading journeys with optimism and ambition. Initial successes fueled the belief that financial independence was within reach, further bolstering the firm’s reputation.

However, beneath the facade of success, cracks began to emerge. Traders who sought to withdraw their profits encountered insurmountable obstacles in the form of payout denials. Despite meeting the firm’s trading targets and fulfilling their obligations, many found themselves locked in a frustrating cycle of rejected withdrawal requests and unfulfilled promises.

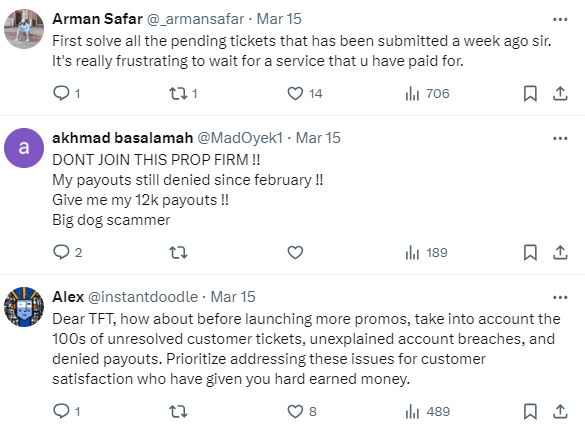

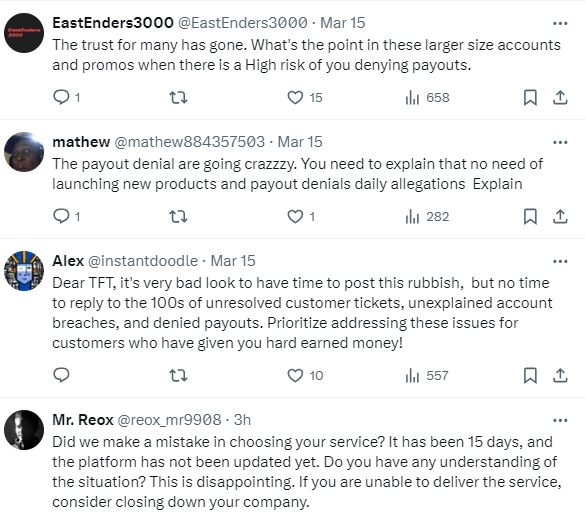

As reports of payout denials spread like wildfire within the trading community, trust in The Funded Trader rapidly eroded. Traders took to online forums and social media platforms to share their experiences and warn others of the firm’s deceptive practices. The once-respected prop firm found itself besieged by accusations and condemnation, its reputation tarnished beyond repair.

Behind the numbers and financial losses lie the human stories of traders who placed their trust in The Funded Trader, only to have their dreams dashed by payout denials. For many, the emotional toll of this betrayal is immeasurable, leaving scars that may take years to heal. The financial repercussions, too, are profound, as traders grapple with the loss of hard-earned profits and shattered aspirations.

The collapse of The Funded Trader serves as a stark reminder of the importance of due diligence and skepticism in the trading world. Aspiring traders must exercise caution when engaging with prop firms, conducting thorough research and scrutinizing their terms and conditions. Transparency, integrity, and a track record of fulfilling payout obligations should be non-negotiable criteria when evaluating potential partners.

In the wake of The Funded Trader’s demise, there is a growing chorus of voices calling for accountability within the prop trading industry. Regulatory bodies and industry associations must take proactive measures to root out bad actors and protect traders from predatory practices. Firms that fail to uphold their commitments should face consequences commensurate with the harm they inflict on traders and the broader trading community.

The fall of The Funded Trader serves as a cautionary tale for traders navigating the complex and often treacherous terrain of prop trading. While the allure of access to capital may be enticing, it is essential to remain vigilant and discerning, particularly in light of the pervasive threat of payout denials. By learning from past mistakes and holding firms accountable, traders can strive to create a safer and more transparent trading environment for all.