In the dynamic world of proprietary trading, Quick Trade Capital is making waves with its innovative approach. Launching in July the 15th, Quick Trade Capital is set to transform the prop firm industry by introducing Pay-As-You-Go Challenge Accounts, a game-changing feature that promises to attract both novice and experienced traders.

The Traditional Model

Traditionally, prop firms require traders to undergo a series of evaluation phases, often referred to as challenges, to prove their trading skills. These challenges typically come with hefty upfront fees and strict rules. Only those who pass these rigorous tests are granted access to the firm’s capital. While this model ensures that only skilled traders are funded, it can be a significant barrier to entry for many, especially those who are unable to afford the initial costs.

Enter Quick Trade Capital

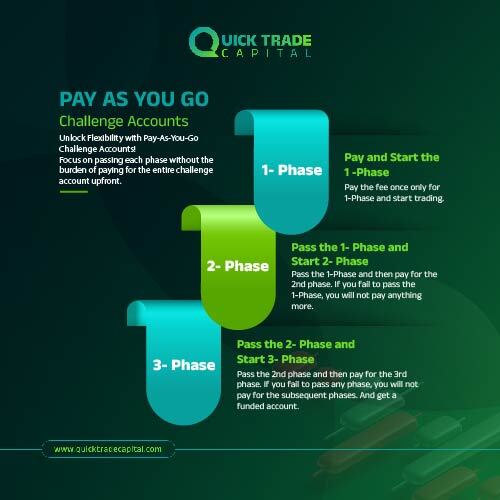

Quick Trade Capital is disrupting this traditional model with its Pay-As-You-Go Challenge Accounts. This innovative approach allows traders to pay for their evaluation in smaller, manageable installments rather than a large upfront fee. By doing so, Quick Trade Capital aims to democratize access to trading opportunities and attract a wider range of talent.

Key Features of Quick Trade Capital

- Flexible Payment Plans: Traders can choose from a variety of payment plans, making it easier for them to manage their finances while pursuing their trading goals.

- Accessibility: Lowering the financial barrier to entry means more aspiring traders can participate, regardless of their economic background.

- Support and Education: Quick Trade Capital offers comprehensive support and educational resources to help traders succeed.

- Advanced Trading Platforms: The firm provides access to cutting-edge trading platforms and tools, ensuring that traders have everything they need to excel.

- Transparent Evaluation Process: The Pay-As-You-Go model maintains the integrity of the evaluation process while making it more transparent and accessible.

The Impact on the Prop Firm Industry

Quick Trade Capital’s innovative approach is likely to have a significant impact on the prop firm industry. By making it easier and more affordable for traders to access capital, the firm is opening up new opportunities for a diverse range of individuals. This could lead to a more inclusive and competitive trading environment, benefiting both traders and the industry as a whole.

Furthermore, the introduction of Pay-As-You-Go Challenge Accounts could encourage other prop firms to adopt similar models, driving positive change across the industry. As more firms recognize the benefits of lowering entry barriers, the prop trading landscape could become more dynamic and accessible.

Quick Trade Capital is poised to revolutionize the prop firm industry with its Pay-As-You-Go Challenge Accounts. By offering flexible payment plans and comprehensive support, the firm is making it easier for traders to access the capital they need to succeed. This innovative approach is not only breaking down financial barriers but also fostering a more inclusive and competitive trading environment. As Quick Trade Capital continues to grow and evolve, it will be exciting to see how its revolutionary model shapes the future of proprietary trading.