Discover Sure Leverage Funding, a Dubai-based prop firm offering diverse funding programs, advanced platforms like MT5, and up to 80% profit splits. Read our review now!

Sure Leverage Funding is a Dubai-registered proprietary trading firm that entered the industry in 2022. With a strong foundation in the financial markets, backed by experienced leadership, innovative trading platforms, and diverse account types, this firm has established itself as a reliable choice for traders.

Company Overview

Year Founded: 2022

Founders and Leadership:

- Sebastian Ness (CEO): With over seven years of trading experience and five years in the brokerage industry, Sebastian Ness brings expertise in financial markets and blockchain ventures.

- Peter Papadeas (CFO): With 20+ years of experience in finance and investing, Peter Papadeas is a seasoned CFD trader with a strong background in risk management and strategic investments.

Headquarters: Dubai, UAE

Regulatory Status: Prop firms, including Sure Leverage Funding, are not regulated by financial authorities.

Trading Platforms

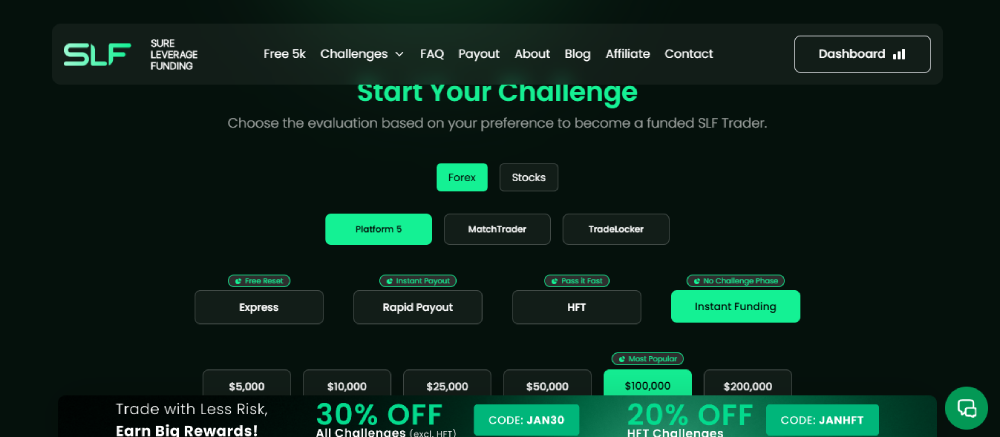

Sure Leverage Funding provides access to top-tier trading platforms:

- MetaTrader 5 (MT5): Offering over 220+ stocks, this platform is ideal for comprehensive trading.

- Match Trader: Features seamless integration with TradingView, enhancing charting and technical analysis.

- Trade Locker: Designed for intuitive trading with advanced tools.

Account Types

Traders can choose from various funding options tailored to different trading styles:

- Instant Funding: Immediate access to capital with a scaling option.

- EA/HFT Challenge: Suitable for expert advisors and high-frequency traders.

- 1-Step Challenge: Simple evaluation process.

- 2-Step Challenge: Traditional evaluation with two phases.

- Stock Challenge (2-Step): Focused on stock trading opportunities.

Evaluation Process

Sure Leverage Funding offers flexible evaluation programs, with details available on their official website.

Key Features:

- Profit Targets: Competitive targets depending on the account type.

- Drawdown Limits: Designed to maintain trader discipline and firm stability.

Fees:

Account size fees and evaluation criteria vary based on the program chosen. Visit the website for a full breakdown.

Profit Sharing

Challenges:

- Up to 80% profit split for successful challenge accounts.

Instant Funding/EA Challenge: - Scaling from 50% to 80% profit split based on performance.

Withdrawal Policies:

- Adherence to a consistency rule and lot size consistency ensures smooth payouts.

- No payout issues reported, even during challenging market conditions.

Financial Stability

Sure Leverage Funding prides itself on financial transparency and reliability:

- Backed by successful business ventures and substantial funding from the owners.

- Payouts are stable, with no reports of delays or denials.

Conclusion

Sure Leverage Funding offers a robust platform for traders of all skill levels. With diverse account options, advanced trading platforms, and a commitment to financial stability, the firm stands out as a dependable choice for traders seeking growth opportunities.

For detailed evaluation criteria, fee structures, and account types, visit Sure Leverage Funding.