The goal of prop trading company Super Funded is to increase trading accessibility. With its affordable funding choices, Super Funded goes above and above to support traders in reaching their objectives. Their financed trader program will yield excellent results, as you can anticipate.

Company Background

Super Funded, established in 2024, is a new entrant in the prop trading industry. While specific details about the founders and key team members remain undisclosed, the company operates under the influence of notable entities such as eightcap and PropTradeTech. Super Funded is headquartered in Australia, with plans to expand to Japan following regulatory compliance. Currently, the firm does not hold any regulatory status.

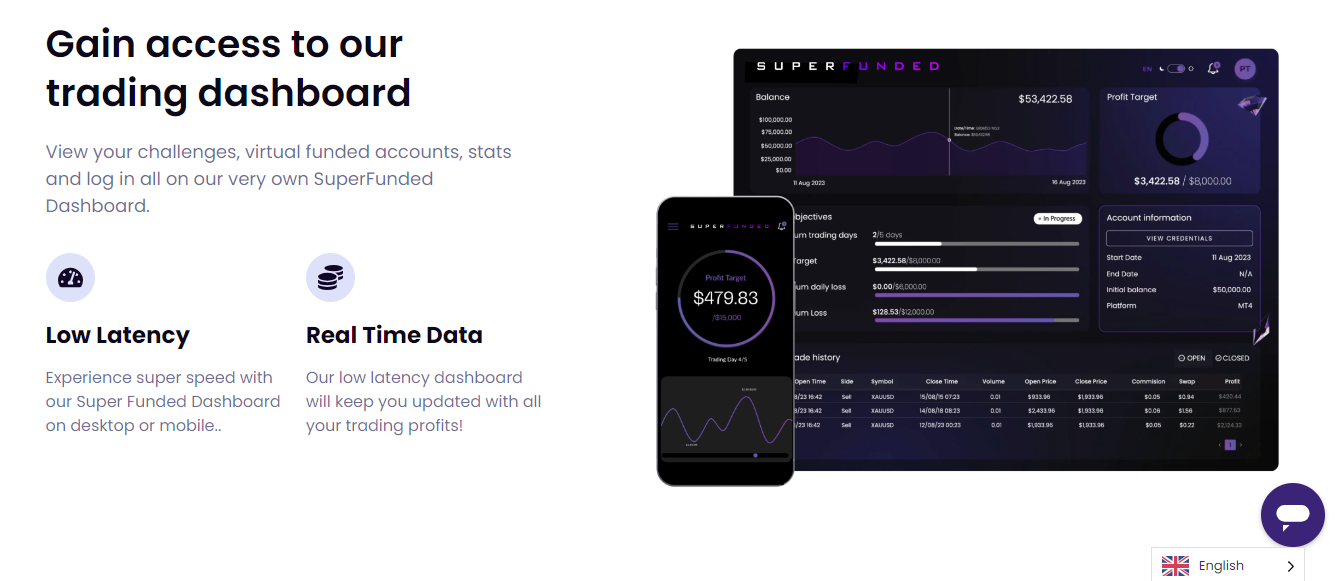

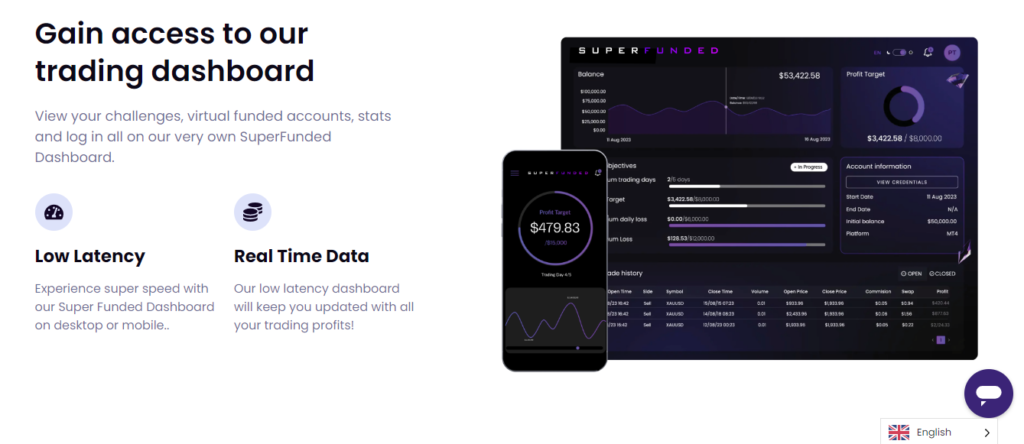

Trading Platform

Super Funded supports the widely-used MetaTrader 4 (MT4) platform, with an upgrade to MetaTrader 5 (MT5) expected soon. The platform boasts ultra-low spreads, making it an attractive choice for traders seeking cost-efficient trading conditions.

Account Types

Super Funded offers a single funding account option. This streamlined approach may appeal to traders looking for simplicity in account selection.

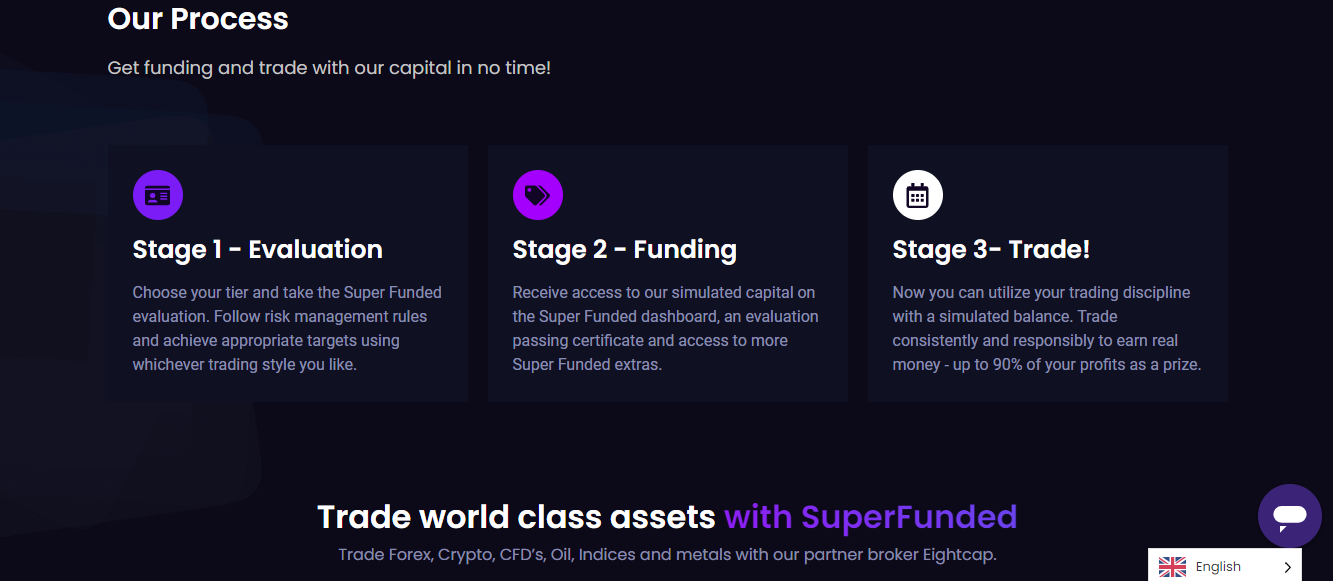

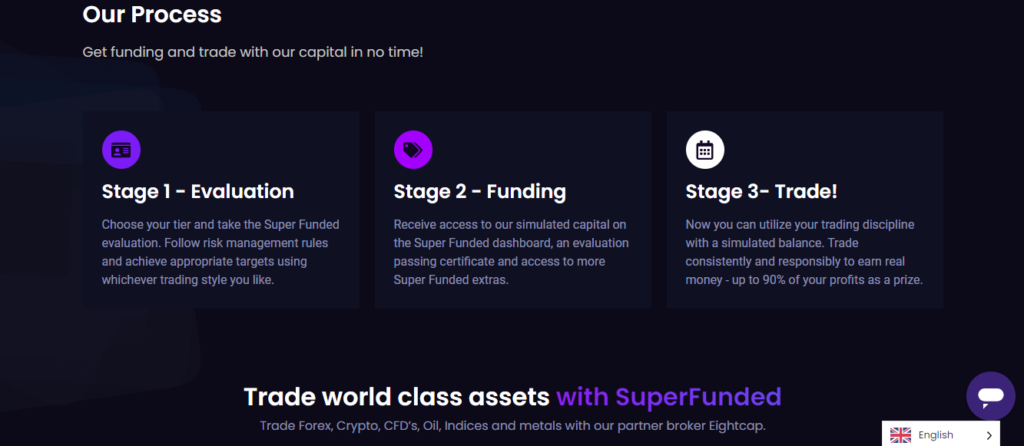

Evaluation Process

The firm employs a two-step evaluation process for traders aiming to secure funded accounts:

Step 1

- Profit Target: 10%

- Drawdown Limit: 5% daily, 10% overall

Step 2

- Profit Target: 5%

- Drawdown Limit: 5% daily, 10% overall

Notably, Super Funded does not charge any fees for the evaluation process, which can be a significant advantage for traders.

Profit Sharing

Super Funded offers a tiered profit-sharing model, starting at a 70% share for the trader, which increases to 80% after the first withdrawal and can reach up to 90% with continued success. Withdrawals require a minimum of 5 trading days and can be made initially after 30 days, with subsequent withdrawals available every 15 days.

Funding and Capital

The financial stability of Super Funded is closely aligned with the eightcap brand, suggesting a solid financial backing. However, specific sources of funds are not disclosed, which might be a point of consideration for potential traders.

Conclusion

Super Funded emerges as a promising prop firm with a straightforward account structure, a robust trading platform, and a flexible profit-sharing scheme. The lack of regulatory status and undisclosed financial details may raise questions for some, but the strong association with eightcap provides a measure of confidence. Traders seeking a new opportunity with attractive profit-sharing potential and no evaluation fees might find Super Funded a suitable partner.