Funded Trader Markets, founded in 2024, is a new player in the prop trading industry. The firm is led by Revin Zabala and is based in Dubai, UAE. While currently registered in the UAE, the company has ambitious plans to expand its regulatory presence by establishing an entity in Cyprus by the end of Q4 2024, under a solid regulatory framework.

Company Background

Funded Trader Markets, founded in 2024, is a new player in the prop trading industry. The firm is led by Revin Zabala and is based in Dubai, UAE. While currently registered in the UAE, the company has ambitious plans to expand its regulatory presence by establishing an entity in Cyprus by the end of Q4 2024, under a solid regulatory framework.

Trading Platforms

Funded Trader Markets supports advanced trading platforms, including MatchTrade and cTrader. The firm is also planning to introduce MetaTrader 5 (MT5) soon, offering traders a range of powerful tools for executing trades and managing their portfolios.

Account Types

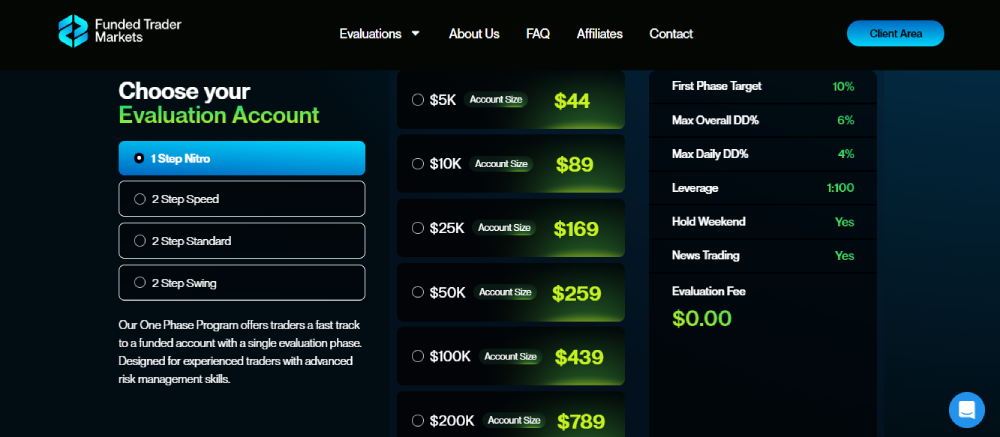

Funded Trader Markets offers a variety of funding account options tailored to different trading styles:

- 1-Step Challenge

- 2-Step Swing Challenge

- 2-Step Speed Challenge

- 2-Step Standard Challenge

These diverse account types cater to various trader preferences, allowing participants to choose a challenge that best aligns with their trading strategy and goals.

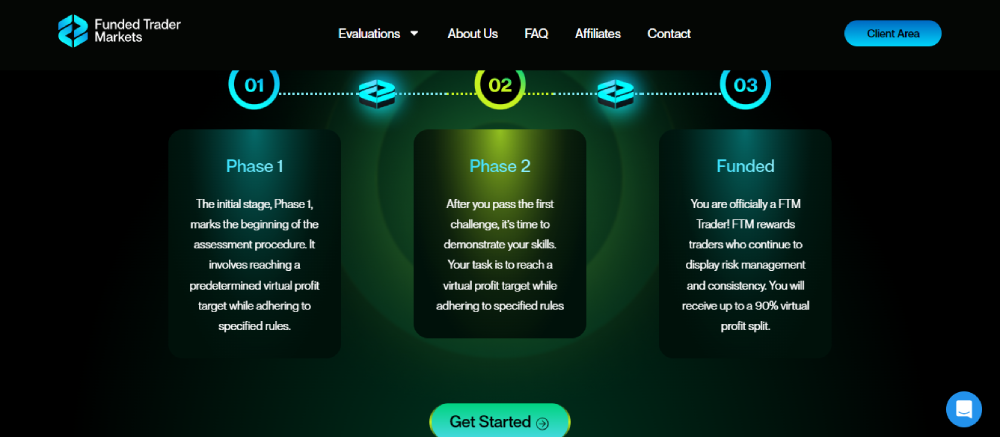

Evaluation Process

The firm’s evaluation process varies based on the challenge type selected, but specific details regarding profit targets, drawdown limits, and other criteria are still to be confirmed. Fees associated with the evaluation will be reviewed at the official launch, providing flexibility for traders to understand the cost structure better.

Profit Sharing

Funded Trader Markets offers an attractive profit-sharing model:

- 100% Profit Split: For the first $10,000 in profits.

- 80/20 Split: Regular profit-sharing beyond the initial $10,000.

This structure is designed to reward traders early in their trading journey, providing full access to their first significant profits.

Withdrawal Conditions and Procedures

The firm allows traders to withdraw profits with a minimum payout of 1%, ensuring that even small profits can be accessed. Withdrawals can be processed through Rise and cryptocurrency, offering convenience and flexibility.

Funding and Capital

Details regarding the financial stability of Funded Trader Markets are not fully disclosed, but inquiries can be directed to the CEO, Revin Zabala, for more specific information. This suggests a degree of transparency and willingness to engage with potential traders about the firm’s financial foundations.

Conclusion

Funded Trader Markets is an exciting new entrant in the prop trading industry with a clear plan for growth and expansion. The variety of challenge options, combined with a generous profit-sharing model, makes it an appealing choice for traders looking to maximize their earning potential. The firm’s commitment to expanding its regulatory framework adds credibility, though more information on its financial stability will be crucial for prospective traders. As the firm finalizes its evaluation fees and further develops its offerings, Funded Trader Markets could emerge as a strong contender in the competitive world of prop trading.