Bullrush stands out with its A-book execution model, real market liquidity, and transparent four-step evaluation process. With on-demand withdrawals, modern trading platforms, and strong financial backing, this firm is worth considering for serious traders.

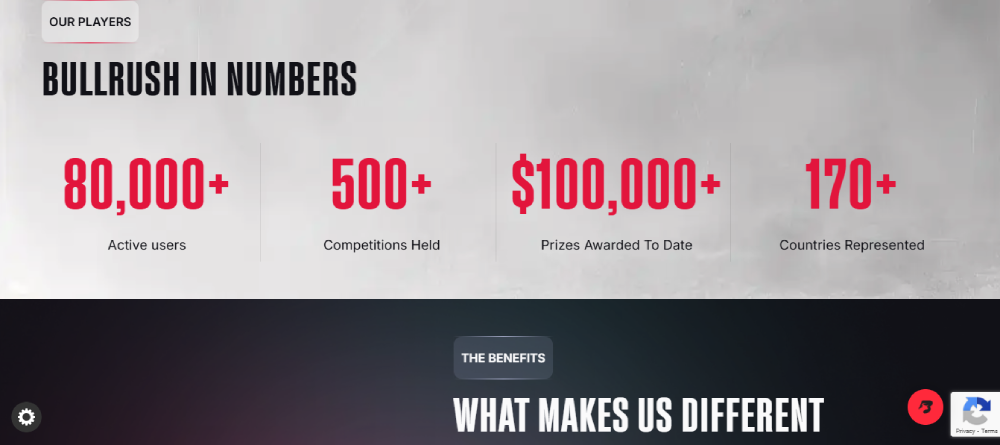

Bullrush is a 2024-founded proprietary trading firm that offers traders a unique, transparent path to funding through a 4-step A-booked challenge. In this Bullrush prop firm review, we’ll cover everything you need to know about their trading platforms, evaluation process, profit splits, and more.

Company Background

- Year Founded: 2024

- CEO: Trent Hoerr

- Headquarters: Carson City, Nevada

- Regulatory Status: Not regulated

Bullrush prides itself on transparency and sustainability through its A-book model, providing real capital to qualified traders while maintaining low risk for the firm.

Trading Platforms

Bullrush supports two leading platforms:

- MatchTrader

- cTrader

These platforms offer:

- A-book execution

- Full transparency of liquidity providers

- On-demand payouts

- Competitive pricing

- An affiliate program for extra income opportunities

Account Types & Evaluation Process

Bullrush only offers A-Booked Challenge accounts. This model ensures the firm aligns with profitable traders by routing trades to real markets.

4-Step Evaluation Process:

- Level 1 – Challenge:

- Profit Target: 10%

- Max Drawdown: 5%

- Level 2 – Challenge:

- Profit Target: 5%

- Max Drawdown: 5%

- Level 3 – Funded:

- Profit Target: 10%

- Withdrawal Condition: 75% of profit is automatically withdrawn upon reaching the target

- Level 4 – Funded:

- Profit Target: 0%

- Withdrawals: On-demand (75% profit share)

Disqualified traders are rewarded with a 5% coupon for their next phase, encouraging long-term participation and learning.

Pricing

Bullrush’s evaluation fees range from $45 to $805, depending on account size and trading conditions. The pricing structure makes it accessible to both beginners and experienced traders.

Profit Sharing & Withdrawals

- Profit Split: 75% at both funded levels

- Withdrawals:

- Level 3: Automatically processed upon meeting the profit target

- Level 4: Traders can request withdrawals on demand

Financial Stability

Bullrush is self-funded and benefits from its founders’ successful prior ventures. The A-book model helps ensure continued financial health by aligning trader performance with firm profitability.