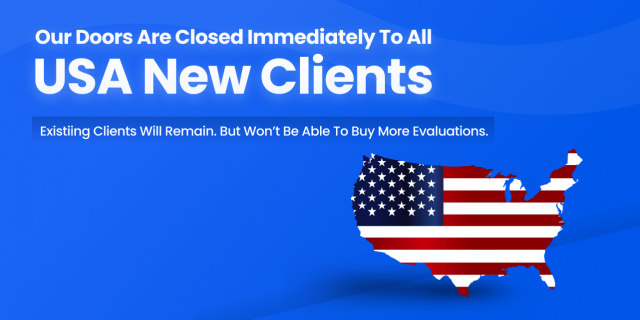

In a recent announcement that sent ripples through the trading community, Funding Pips, a prominent proprietary trading firm, declared its decision to cease offering services to clients based in the United States. The move, though unexpected, reflects a strategic shift in the company’s operations and regulatory considerations.

Funding Pips, known for its innovative approach to proprietary trading, has garnered a loyal client base worldwide. However, the decision to discontinue services for US clients marks a significant change in its business model and regulatory compliance strategy.

The reasons behind this move are multifaceted, but one primary factor likely revolves around regulatory compliance. The financial landscape in the United States is governed by stringent regulations enforced by agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). These regulations are designed to protect investors and ensure the integrity of the financial markets. However, they also impose substantial compliance burdens on financial institutions. For Funding Pips, navigating the complex regulatory environment while catering to US clients may have become increasingly challenging. By focusing on serving clients outside the US, Funding Pips can streamline its operations and allocate resources more efficiently.

While the decision to halt services for US clients may disappoint some traders, it’s essential to recognize that Funding Pips remains committed to its core values of transparency, integrity, and excellence in trading. The firm continues to offer its proprietary trading platform, advanced analytics tools, and personalized support to clients around the world.

For traders impacted by this decision, exploring alternative trading firms and platforms may present new opportunities. The trading landscape is diverse, with numerous options available to suit different trading styles and preferences. By conducting thorough research and due diligence, traders can find a reputable firm that aligns with their goals and values.