Supertrade Prop Firm offers instant & evaluation-based funding with 50-80% profit splits. Learn about fees, platforms, withdrawal rules & more in this review.

Supertrade is a proprietary trading firm established in 2024, offering traders funded accounts through structured evaluation programs and instant funding options. This review examines its platform capabilities, account structures, and operational framework.

1. Company Overview

- Year Founded: 2024

- Leadership: Petro Vinnikov (Sole Shareholder)

- Headquarters: Rodney Bay, Saint Lucia

- Regulatory Status: Unregulated

- Primary Platform: Yourfintech

2. Trading Platform: Yourfintech

Supertrade operates exclusively on the Yourfintech platform, featuring:

Core Functionalities

- Execution: Ultra-low latency engine supporting high-frequency strategies

- Charting: Multi-chart layouts with direct trade execution

- Risk Management: Cross-margin, hedging, and netting modes

- Automation: Custom alerts, position reversal tools, and partial close functionality

- Analytics: Integrated economic calendar, news feeds, and performance reporting

3. Funding Program Structure

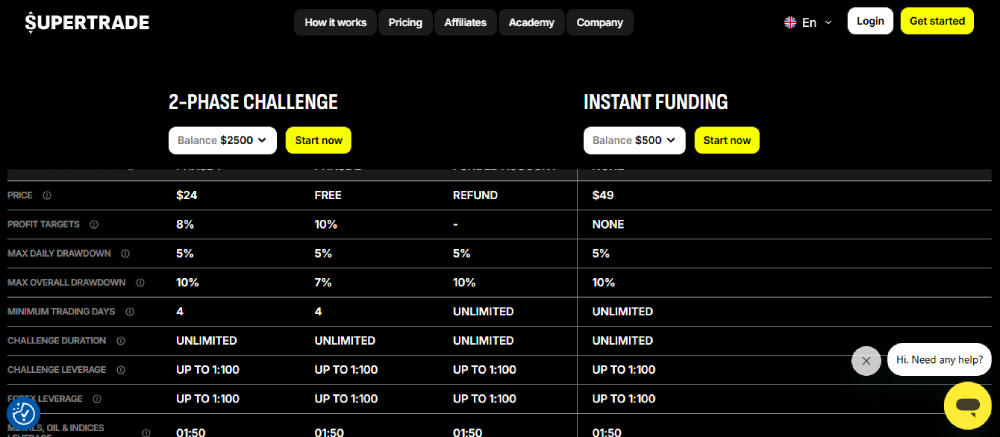

A. Swing 2-Phase Evaluation

- Phase 1 Requirements:

- Profit Target: 10%

- Maximum Drawdown: 10% (Daily: 5%)

- Minimum Trading Days: 4

- Phase 2 Requirements:

- Profit Target: 8%

- Maximum Drawdown: 7%

Fee Structure:

| Account Size | Evaluation Fee |

|---|---|

| $2,500 | $24 |

| $100,000 | $999 |

B. Instant Funding

- No evaluation required

- Profit Share: 50% trader / 50% firm

Fee Structure:

| Account Size | Activation Fee |

|---|---|

| $500 | $49 |

| $100,000 | $7,999 |

4. Financial Terms

- Profit Distribution:

- Swing Accounts: 80% to trader

- Instant Accounts: 50% to trader

- Withdrawal Protocol:

- Frequency: Bi-weekly/Monthly

- Processing: 1-3 business days

- Methods: Bank transfer, cryptocurrency, e-wallets

5. Risk Management & Compliance

- Capital Security: Backed by shareholder equity

- Liquidity Management: Segregated operational funds

- Trader Protections:

- Enforced daily drawdown limits

- Mandatory minimum trading days

Conclusion

Supertrade presents a technologically advanced platform with flexible funding options, catering to traders who prioritize execution speed over regulatory oversight. The firm’s structured evaluation programs and instant access accounts provide multiple pathways to funded trading, though the 50% profit retention on instant accounts may influence trader preference.