In the tumultuous world of finance, trust is paramount. Traders rely on firms to safeguard their investments and uphold their commitments. However, recent events surrounding The Funded Trader, a prominent proprietary trading firm, have shattered this trust, leaving clients reeling from breached promises and denied payouts. Adding insult to injury, the firm has now announced a rebranding effort, a move met with widespread skepticism and discontent among its clientele.

The Funded Trader, once heralded as a beacon of opportunity for aspiring traders, now finds itself mired in controversy. Reports have emerged of the firm’s systematic breach of trust, with allegations of manual breaches of clients’ accounts and withholding of payouts. Such actions not only betray the fundamental principles of integrity but also jeopardize the financial well-being of those who entrusted their capital to the firm’s care.

For traders who poured their time, effort, and capital into The Funded Trader’s programs, the news of the firm’s rebranding comes as a bitter pill to swallow. It raises questions about the sincerity of the firm’s intentions and its commitment to rectifying the grievances of its aggrieved clients. Instead of addressing the root causes of dissatisfaction, the rebranding appears to be a thinly veiled attempt to escape accountability and salvage the tarnished reputation of the company.

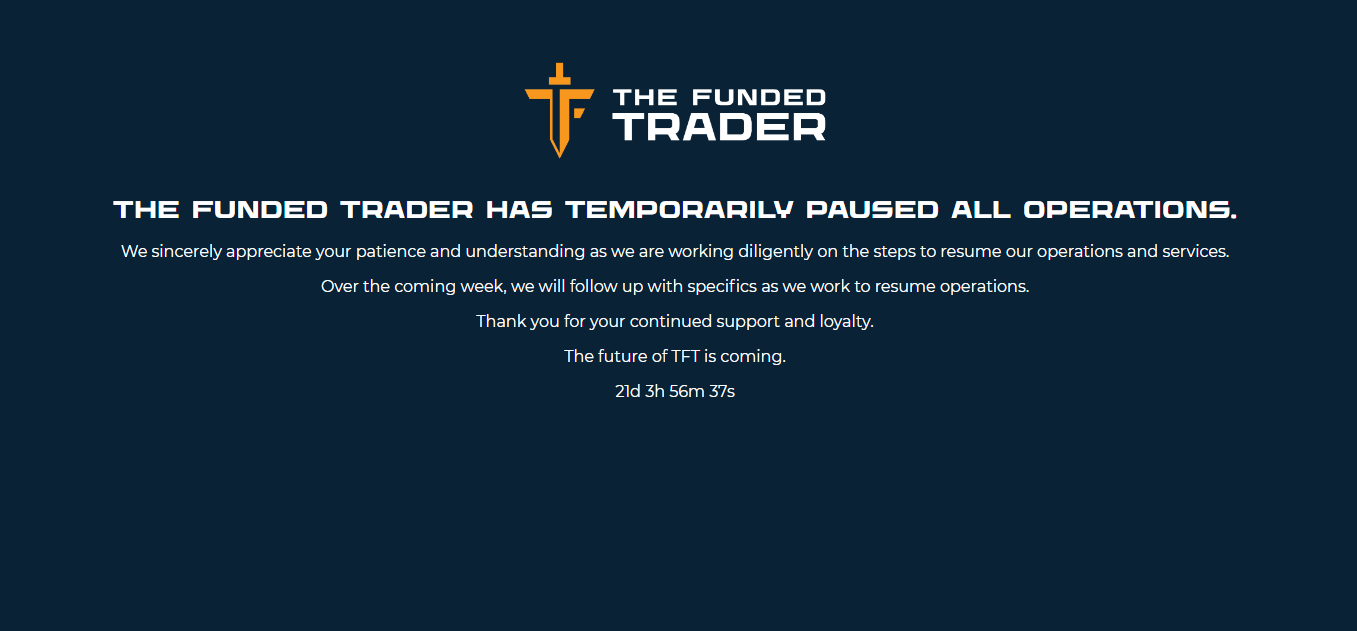

The timing of this rebranding is particularly suspect, coming on the heels of mounting pressure and public outcry against The Funded Trader’s alleged misconduct. It smacks of a desperate ploy to evade scrutiny and erase the stains of past transgressions. However, such tactics are unlikely to succeed in an age where transparency and accountability reign supreme.

Moreover, the rebranding effort raises concerns about the fate of existing clients and the future of The Funded Trader’s operations. Will the firm honor its commitments to those who have yet to receive their rightful payouts? Or will it continue to prioritize its own interests at the expense of its clients’ trust and financial well-being?

In the wake of these developments, it is imperative for traders to exercise caution and due diligence when choosing a trading firm to partner with. While the allure of high returns and lucrative opportunities may be enticing, it is essential to prioritize integrity, reliability, and transparency above all else.

As for The Funded Trader, the road to redemption will be long and arduous. Mere rebranding will not suffice to mend the fractures in trust that have been laid bare. It will require genuine contrition, restitution for past wrongs, and a renewed commitment to upholding the highest standards of ethical conduct.

The Funded Trader’s rebranding may offer a temporary reprieve from public scrutiny, but it does little to address the underlying issues that have eroded trust and credibility. Traders must remain vigilant and hold firms accountable for their actions, lest history repeat itself and further erode the integrity of the financial industry.